UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

ROLLINS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

ROLLINS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 22, 2008

2170 Piedmont Road, N.E., Atlanta, Georgia 30324

TO THE HOLDERS OF THE COMMON STOCK:DEAR STOCKHOLDER:

PLEASE TAKE NOTICEthat the 20062008 Annual Meeting of Stockholders of Rollins, Inc.ROLLINS, INC., a Delaware corporation (the "Company"), will be held at the Company's offices located at 2170 Piedmont Road, N.E., Atlanta, Georgia, on Tuesday, April 25, 2006,22, 2008, at 12:30 P.M., or any adjournment thereof, for

At the following purposes:meeting you will be asked to:

The Proxy Statement dated April 4, 2006March 17, 2008 is attached.

The Board of Directors has fixed the close of business on March 17, 2006,February 29, 2008, as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting.

Stockholders who do not expect to be present at the meeting are urged to complete, date, sign, and return the enclosed proxy. No postage is required if the enclosed envelope is used and mailed in the United States.

BY ORDER OF THE BOARD OF DIRECTORS | ||

| ||

| Michael W. Knottek Senior Vice President—Secretary |

Atlanta, GeorgiaGAApril 4, 2006March 17, 2008

Please complete, sign and date the proxy card as promptly as possible and return it in the enclosed envelope.

PROXY STATEMENT

ROLLINS, INC.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 22, 2008

This Proxy Statement and a form of proxy were first mailed to stockholders on or about April 4, 2006.March 17, 2008. The following information concerning the enclosed proxy and the matters to be acted upon at the Annual Meeting of Stockholders to be held on April 25, 2006,22, 2008, is submitted by the Company to the stockholders in connection with the solicitation of proxies on behalf of the Company's Board of Directors.

SOLICITATION OF AND POWER TO REVOKE PROXY

A form of proxy is enclosed. Each proxy submitted will be voted as directed, but if not otherwise specified, proxies solicited by the Board of Directors of the Company will be voted in favor of the candidates for election to the Board of Directors.Directors and in favor of the proposals to approve the Performance-Based Incentive Cash Compensation Plan for Executive Officers and the 2008 Stock Incentive Plan.

A stockholder executing and delivering a proxy has power to revoke the same and the authority thereby given at any time prior to the exercise of such authority, if he so elects, by contacting either proxy holder or by attending the meeting and voting in person. However, a beneficial stockholder who holds his shares in street name must secure a proxy from his broker before he can attend the meeting and vote. All costs of solicitation have been, and will be, borne by the Company.

Householding and Delivery of Proxy Materials

The Company has adopted the process called "householding" for mailing the proxy material in order to reduce printing costs and postage fees. Householding means that stockholders who share the same last name and address will receive only one copy of the Proxy Material, unless we receive contrary instructions from any stockholder at that address. The Company will continue to mail a proxy card to each stockholder of record.

If you prefer to receive multiple copies of the proxy material at the same address, additional copies will be provided to you promptly upon written or oral request. If you are a stockholder of record, you may contact us by writing to the Company 2170 Piedmont Rd., NE, Atlanta, GA 30324 or by calling 404-888-2000. Eligible stockholders of record receiving multiple copies of the Proxy Material can request householding by contacting the Company in the same manner.

The outstanding capital stock of the Company on March 17, 2006February 29, 2008 consisted of 68,585,567100,876,558 shares of Common Stock, par value $1.00 per share. Holders of Common Stock are entitled to one vote (non-cumulative) for each share of such stock registered in their respective names at the close of business on March 17, 2006,February 29, 2008, the record date for determining stockholders entitled to notice of and to vote at the meeting or any adjournment thereof.

A majority of the outstanding shares will constitute a quorum at the Annual Meeting. Abstentions will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. In accordance with the General Corporation Law of the state of Delaware, the election of the nominees named herein as Directors will require the affirmative vote of a plurality of the votes cast by the shares of Company Common Stock entitled to vote in the election provided that a quorum is present at the Annual Meeting. In the case of a plurality vote requirement (as in the election of

directors), where no particular percentage vote is required, the outcome is solely a matter of comparing the number of votes cast for each nominee, with those nominees receiving the most votes being elected, and hence only votes for director nominees (and not abstentions) are relevant to the outcome. In this case, the two nominees receiving the most votes will be elected. The affirmative vote of holders of a majority of the outstanding shares of Common Stockcommon stock of the Company entitled to vote and present in person or by proxy at the Annual Meeting is required for approval of the proposal to amend the Certificate of Incorporation. With respect to the proposalproposals to approve the amendment toPerformance-Based Incentive Cash Compensation Plan for Executive Officers and the Company's Certificate of Incorporation, abstentions and broker non-votes2008 Stock Incentive Plan. Abstentions will have the effect of a vote against those proposals and broker non-votes will be disregarded and will have no effect on the proposal.outcome of the vote on those proposals. There are no rights of appraisal or similar dissenter's rights with respect to any matter to be acted upon pursuant to this Proxy Statement. It is expected that shares held of record by officers and directors of the Company, which in the aggregate represent approximately 56.859 percent of the outstanding shares of Common Stock, will be voted for the nominees and the proposals to approve the Performance-Based Incentive Cash Compensation Plan for directorsExecutive Officers and in favor of the proposal to amend the Certificate of Incorporation.2008 Stock Incentive Plan.

The names of the executives named in the Summary Compensation Table and the name and address of each stockholder (or "group" as that term is used in Section 13(d)(3) of the Securities Exchange Act)Act of 1934, as amended (the "Exchange Act")) who owned beneficially over five percent (5%) of the shares of Common Stock of the Company on March 17, 2006,February 29, 2008, together with the number of shares owned by each such person and the percentage of outstanding shares that ownership represents, and information as to Common Stock ownership of the

executive officers and directors of the Company as a group (according to information received by the Company) are set out below:

| Name and Address of Beneficial Owner | Amount Beneficially Owned(1) | Percent of Outstanding Shares | ||

|---|---|---|---|---|

| R. Randall Rollins Chairman of the Board 2170 Piedmont Road, N.E. Atlanta, Georgia | 33,718,977 | (2) | 49.2 | |

Gary W. Rollins Chief Executive Officer, President and Chief Operating Officer 2170 Piedmont Road, N.E. Atlanta, Georgia | 34,889,703 | (3) | 50.9 | |

Mario Gabelli One Corporate Center Rye, New York 10020 | 6,141,506 | (4) | 9.0 | |

Michael W. Knottek Senior Vice President and Secretary | 2,224,856 | (5) | 3.2 | |

Harry J. Cynkus Chief Financial Officer and Treasurer | 757,639 | (6) | 1.1 | |

Glen Rollins Vice President | 726,148 | (7) | 1.1 | |

All Directors and Executive Officers as a group (9 persons) | 38,965,303 | (8) | 56.8 |

STOCK OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

| Name and Address of Beneficial Owner | Amount Beneficially Owned(1) | Percent of Outstanding Shares | ||

|---|---|---|---|---|

| R. Randall Rollins Chairman of the Board 2170 Piedmont Road, N.E. Atlanta, Georgia | 50,832,019 | (2) | 50.4 | |

| Gary W. Rollins Chief Executive Officer, President and Chief Operating Officer 2170 Piedmont Road, N.E. Atlanta, Georgia | 51,944,426 | (3) | 51.5 | |

| Mario Gabelli One Corporate Center Rye, New York 10020 | 6,005,829 | (4) | 6.0 | |

| Glen Rollins Vice President 2170 Piedmont Road, N.E. Atlanta, Georgia | 1,195,428 | (5) | 1.2 | |

| Harry J. Cynkus Chief Financial Officer and Treasurer 2170 Piedmont Road, N.E. Atlanta, Georgia | 1,153,298 | (6) | 1.1 | |

| Michael W. Knottek Senior Vice President and Secretary 2170 Piedmont Road, N.E. Atlanta, Georgia | 3,465,436 | (7) | 3.4 | |

| All Directors and Executive Officers as a group (10 persons) | 59,307,323 | (8) | 58.8 |

Mr. R. Randall Rollins and Mr. Gary W. Rollins have voting control of LOR, Inc. Also includes 3,8195,728 shares of Company Common Stock in an individual retirement account. Also includes options to purchase 225,000account and 336 shares of Company Common Stock which are currently exercisable or will become exercisable within 60 days ofin the date hereof.Rollins, Inc. 401(k) Plan. Mr. Rollins is part of a control group holding company securities that includes Mr. Gary Rollins, as disclosed on a Schedule 13D on file with the U.S. Securities and Exchange Commission.

Mr. Gary W. Rollins have voting control of LOR, Inc. Also includes 36,157 shares of Company Common Stock held by the Rollins 401(k) Plan and 1901,891 shares of Company Common Stock in the Company's employee stock purchase plan. Also includes options to purchase 450,000plan and 60,092 shares of Company Common Stock which are currently exercisable or will become exercisable within 60 days ofheld by the date hereof.Rollins 401(k) Plan. Mr. Rollins is part of a control group holding company securities that includes Mr. R. Randall Rollins, as disclosed on a Schedule 13D on file with the U.S. Securities and Exchange Commission.

Stock Ownership Requirements

The Company has adopted stock ownership guidelines for the named executive officers identified in the previous table and for key executives designated by the Compensation Committee. The current guidelines as determined by the Compensation Committee include:

The covered executives have a period of four years in which to satisfy the guidelines, either from the date of adoption of the policy on November 1, 2006, or the date of appointment to a qualifying position, whichever is later. Shares counted toward this requirement will be based on shares beneficially owned by such executive (as beneficial ownership is defined by the SEC's rules and regulations) including shares owned outright by the executive, shares held in Rollins 401(k) retirement savings plan, stock held in Rollins employee stock purchase and/or dividend reinvestment plan, shares obtained through stock option exercise and held, restricted stock awards whether or not vested and shares held in trust in the employee's name. Once achieved, ownership of the guideline amount must be maintained for as long as the individual is subject to the Executive Stock Ownership Guidelines and the executive is required to retain a minimum of 25% of any future equity awards.

At the Annual Meeting, Mr. Gary W.R. Randall Rollins and Mr. HenryJames B. TippieWilliams will be nominated to serve as Class III directors for a term of three years, and until the election and qualification of their successors. FourFive other individuals serve as directors but are not standing for re-election because their terms as directors extend past this Annual Meeting pursuant to provisions of the Company's by-laws, which provide for the election of directors for staggered terms, with each director serving a three-year term. Unless authority is withheld, the proxy holders will vote for the election of each nominee named below as a director. Although Management does not contemplate the possibility, in the event any nominee is not a candidate or is unable to serve as director at the time of the election, unless authority is withheld, the proxies will be voted for any nominee who shall be designated by the present Board of Directors and recommended by the Nominating and Governance Committee to fill such vacancy.

The name and age of each of the two nominees, their principal occupations, together with the number of shares of Common Stock beneficially owned, directly or indirectly, by each nominee and the percentage of outstanding shares that ownership represents, all as of the close of business March 17, 2005February 29, 2008 (according to information received by the Company) are set out below. Similar information is also provided for those directors whose terms expire in future years.

| Name | Principal Occupation (1) | Service as Director | Age | Shares of Common Stock (2) | Percent of Oustanding Shares | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Class I (Term Expires 2008) | ||||||||||

R. Randall Rollins(3) | Chairman of the Board of the Company; Chairman of the Board of RPC, Inc. (oil and gas field services); and Chairman of the Board of Marine Products Corporation (boat manufacturing) | 1968 to date | 74 | 33,718,977 | (4) | 49.9 | ||||

| James B. Williams | Chairman of the Executive Committee of SunTrust Banks, Inc. (bank holding company) from 1998 to April 2004; and Chairman of the Board and Chief Executive Officer of SunTrust Banks, Inc. from 1991 to 1998 | 1978 to date | 73 | 45,000 | * | |||||

| Class II (Current Term Expires 2006, New Term Will Expire 2009) | ||||||||||

| Gary W. Rollins(3) | Chief Executive Officer, President and Chief Operating Officer of the Company | 1981 to date | 61 | 34,889,703 | (5) | 51.7 | ||||

| Henry B. Tippie | Presiding Director of the Company; Chairman of the Board and Chief Executive Officer of Tippie Services, Inc. (management services); Chairman of the Board of Dover Downs Gaming and Entertainment, Inc. (operator of multi-purpose gaming and entertainment complex) since January 2002; and Chairman of the Board of Dover Motorsports, Inc. (operator of motorsports tracks) | 1960 to 1970; 1974 to date | 79 | 774,224 | (6) | 1.1 | ||||

| Name | Principal Occupation(1) | Service as Director | Age | Shares of Common Stock(2) | Percent of Outstanding Shares | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Names of Director Nominees | ||||||||||

| Class I (Current Term Expires 2008, New Term Will Expire 2011) | ||||||||||

| R. Randall Rollins (3) | Chairman of the Board of the Company; Chairman of the Board of RPC, Inc. (oil and gas field services); and Chairman of the Board of Marine Products Corporation (boat manufacturing) | 1968 to date | 76 | 50,832,019 | (4) | 50.4 | ||||

| James B. Williams | Chairman of the Executive Committee of SunTrust Banks, Inc. (bank holding company) from 1998 to April 2004; and Chairman of the Board and Chief Executive Officer of SunTrust Banks, Inc. from 1991 to 1998 | 1978 to date | 74 | 67,500 | * | |||||

Names of Directors Whose Terms Have Not Expired | ||||||||||

| Class III (Term Expires 2011) | ||||||||||

| Wilton Looney | Honorary Chairman of the Board of Genuine Parts Company (automotive parts distributor) | 1975 to date | 88 | 5,062 | * | |||||

| Bill J. Dismuke | Retired President of Edwards Baking Company (manufacturer of baked pies and pie pieces) | 1984 to date | 71 | 3,037 | * | |||||

| Thomas J. Lawley | Dean of the Emory University School of Medicine since 1996 | 2006 to date | 61 | — | * | |||||

| Class III (Term Expires 2007) | ||||||||||

| Wilton Looney | Honorary Chairman of the Board of Genuine Parts Company (automotive parts distributor) | 1975 to date | 86 | 3,375 | * | |||||

| Bill J. Dismuke | Retired President of Edwards Baking Company (manufacturer of baked pies and pie pieces) | 1984 to date | 69 | 2,025 | * | |||||

Class II (Term Expires 2009) | ||||||||||

| Gary W. Rollins (3) | Chief Executive Officer, President and Chief Operating Officer of the Company | 1981 to date | 63 | 51,944,426 | (5) | 51.5 | ||||

| Henry B. Tippie | Presiding Director of the Company; Chairman of the Board and Chief Executive Officer of Tippie Services, Inc. (management services); Chairman of the Board of Dover Downs Gaming and Entertainment, Inc. (operator of multi-purpose gaming and entertainment complex) since January 2002; and Chairman of the Board of Dover Motorsports, Inc. (operator of motorsports tracks) | 1960 to 1970; 1974 to date | 81 | 1,161,336 | (6) | 1.2 | ||||

Our Board of Directors recommends a vote FOR the nominees listed.

CORPORATE GOVERNANCE AND

BOARD OF DIRECTORS COMPENSATION,DIRECTORS'

COMMITTEES AND MEETINGS

Board Meetings and Compensation

Under current compensation arrangements, non-employee directors each receive an annual retainer fee of $16,000. In addition, the Chairman of the Audit Committee receives an annual retainer of $12,000 and the chairman of each of the Compensation Committee, Corporate Governance/Nominating Committee and Diversity Committee receives an annual retainer of $4,000. A director that chairs more than one committee receives a retainer with respect to each Committee he chairs. All of the retainers are paid on a quarterly basis. Per meeting fees for non-employee directors are as follows:

The Board of Directors met fourfive times during the fiscal year ended December 31, 2005.2007. No director attended fewer than 75 percent of the Board meetings held during such director's term of service and meetings of committees on which he served during 2005. Board members are encouraged to attend our Annual Stockholder Meetings and all Board members were in attendance at last year's meeting. The Board of Directors has the following standing Committees: Audit Committee, Compensation Committee, Executive Committee, Nominating and Governance Committee, and the Diversity Committee.2007. In addition, the Company has from time to time formed a special committee for the purpose of evaluating and approving certain transactions in which other directors of the Company have an interest. During 2005,2007, the Company had no such committee.

The Board of Directors has an Audit Committee, Compensation Committee and a Nominating and Governance Committee.

Below is a summary of our committee structure and membership information.

| Board of Directors | Audit Committee | Compensation Committee | Diversity Committee | Executive Committee | Nominating & Governance Committee | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| R. Randall Rollins(1) | Member | |||||||||

| Henry B. Tippie(2) | Chair | Chair | Chair | Chair | ||||||

| Wilton W. Looney(2) | Member | Member | Member | Member | ||||||

| James B. Williams(2) | Member | Member | Member | Member | ||||||

| Bill J. Dismuke(2) | Member | |||||||||

| Gary W. Rollins(3) | Member | |||||||||

| Thomas J. Lawley M.D. |

Audit Committee

The Audit Committee of the Board of Directors of the Company consists of Henry B. Tippie (Chairman), Wilton Looney, James B. Williams and Bill Dismuke. The Audit Committee held five meetings during the fiscal year ended December 31, 20052007 including a meeting to review the Company's Form 10-K for the year ending December 31, 2004.2006. The Board of Directors has determined that all of the members of the Audit Committee are independent as that term is defined by the rules of the Securities and Exchange Commission ("SEC") and the New York Stock Exchange ("NYSE"). The Board of Directors has also determined that all of the Audit Committee members are "Audit Committee Financial Experts" as defined in the SEC rules. Additionally, the Board of Directors has determined that the simultaneous service by Mr. James B. Williams on the Audit Committees of three other publicly traded companies does not impair his ability to effectively serve on the Audit Committee of Rollins, Inc.the Company. The Audit Committee meets with the Company's independent public accountants, internal auditor, Chief Executive Officer and Chief Financial Officer to review the scope and results of audits and recommendations made with respect to internal and external accounting controls and specific accounting and financial reporting issues. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from the Company for, outside legal, accounting or other advisors as it deems necessary to carry out its duties. The Audit Committee charter is available on the Company's website at www.rollins.com, under the Governance section. A copy of the charter is also available in print, without charge, to any shareholder who requests it.

Compensation Committee

The Compensation Committee of the Board of Directors of the Company consists of Henry B. Tippie (Chairman), Wilton Looney and James B. Williams. It held one meeting during the fiscal year ended December 31, 2005.2007. The function of the Compensation Committee is to set the base salary and cash based incentive compensation of all of the executive officers of the Company. The Compensation Committee also administers the Rollins, Inc. Employee Stock Incentive Plan.

Executive The Compensation Committee

The Executive Committee of does not have a formal charter, and is not required to have one under the Board of Directors of"controlled company" exemption under the Company consists of R. Randall RollinsNYSE rules, as described in the section titled "Director Independence and Gary W. Rollins. It held one meeting and took 17 actions by unanimous consent during the fiscal year ended December 31, 2005. The function of the Executive Committee is to take all permitted actions of the Board in its stead as permitted by the Company's by-laws. The members of the Executive Committee do not receive any additional compensation for their duties on the Committee.NYSE Requirements" below.

Nominating and Governance Committee

The Nominating and Governance Committee of the Board of Directors of the Company consists of Henry B. Tippie (Chairman), Wilton Looney and James B. Williams, each of whom is independent, as discussed above. The Committee was formed in 2002 pursuant to a resolution passed by the Board of Directors for the following purposes:

The Nominating and Governance Committee held one meeting during the fiscal year ended December 31, 2005.2007.

Director Nominations

Under Delaware law, there are no statutory criteria or qualifications for directors. NoThe Board has prescribed no criteria or qualifications have been prescribed by the Board at this time. The Nominating and Governance Committee does not have a charter or a formal policy with regard to the consideration of director candidates. However, it acts under the guidance of the corporate governance guidelines approved by the Board of Directors on January 27, 2004, as amended January 25, 2005, and posted on the Company's website at www.rollins.com under the Governance section. A copy of the corporate governance guidelines is also available in print, without charge, to any shareholder who requests it. The Board believes that it should preserve maximum flexibility in order to select directors with sound judgment and other desirable qualities. According to the Company's corporate governance guidelines, the Board of Directors will be responsible for selecting nominees for election to the Board of Directors. The Board delegates the screening process involved to the Nominating and Governance Committee. This Committee is responsible for determining the appropriate skills and characteristics required of Board members in the context of the then current make-up of the Board. This determination takes into account all factors which the Committee considers appropriate, such as independence, experience, strength of character, mature judgment, technical skills, diversity, age and the extent to which the individual would fill a present need on the Board. The Company's by-laws provide that nominationsany stockholder entitled to vote for the election of directors may be made by any stockholder entitled to votemake nominations for the election of directors. Nominations must comply with an advance notice procedure which generally requires, with respect to nominations for directors for election at an annual meeting, that

written notice be addressed to: Secretary, Rollins Inc., 2170 Piedmont Road, N.E., Atlanta, Georgia 30324, not less than ninety days prior to the anniversary of the prior year's annual meeting and set forth the name, age, business address and, if known, residence address of the nominee proposed in the notice, the principal occupation or employment of

the nominee for the past five years, the nominee's qualifications, the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and any other information relating to the person that would be required to be disclosed in a proxy statement or other filings. Other requirements related to the notice are contained in the Company's bylaws.by-laws. The Committee will consider nominations from stockholders who satisfy these requirements. The Committee is responsible for screening the nominees that are selected by the Board of Directors for nomination to the Board and for service on committees of the Board. The Company has not received a recommendation for a director nominee from a shareholder. All of the nominees for directors being voted upon at the Annual Meeting to be held on April 25, 200622, 2008 are directors standing for re-election.

Director Communications

The Company also has a process for interested parties, including stockholders, to send communications to the Board of Directors, Presiding Director, any of the Board Committees or the non-management directors as a group. Such communications should be addressed as follows:

Mr. Henry B. Tippiec/o Internal Audit DepartmentRollins, Inc.2170 Piedmont Road, N.E.Atlanta, Georgia 30324.

Instructions for communications with the directors are also posted on our website at www.rollins.com under the Governance section. All communications received from interested parties are forwarded to the Board of Directors. Any communication addressed solely to the Presiding Director or the non-management directors will be forwarded directly to the appropriate addressee.

Diversity Committee

The Diversity Committee of the Board of Directors of the Company consists of Henry B. Tippie (Chairman), Wilton Looney and James B. Williams. It held one meeting during the fiscal year ended December 31, 2005. The function of the Diversity Committee is to monitor compliance with applicable non-discrimination laws.

Director Independence and NYSE requirementsRequirements

"ControlledControlled Company Exemption." The Company is not required by law or NYSE listing requirementsWe have elected to have a nominating or compensation committee composed of independent directors, nor to have a board of directors the majority of which are independent. Because the Company isbe treated as a "controlled corporation,"company" as defined by NYSE Rule 303A.00,New York Stock Exchange Section 303A.00. This Section provides that a controlled company need not comply with the Company is exempt from NYSE Rulesrequirements of Sections 303A.01, 303A.04 and 303A.05 andof the New York Stock Exchange Listed Company Manual. Section 303A.01 requires that listed companies have a majority of independent directors. As a controlled company, this Section does not undertake complianceapply to us. Sections 303A.04 and 303A.05 require that listed companies have a nominating and corporate governance committee and a compensation committee, in each case composed entirely of independent directors, and that each of these committees must have a charter that addresses both the committee's purpose and responsibilities and the need for an annual performance evaluation by the committee. While we have a nominating and corporate governance committee and a compensation committee, we are not required to and do not comply with those provisions. The Company isall of the provisions of Sections 303A.04 and 303A.05. We are a "controlled corporation"company" because a group that includes the Company's Chairman, of the Board R. Randall Rollins, his brother, Gary W. Rollins who is a director and CEOChief Executive Officer of the Company, and his nephew Glen Rollins who is the son of Gary W. Rollins' sonRollins and Vice President of Rollins, Inc.,the Company, and certain companies under their control, possesses in excess of fifty percent of the Company'sour voting power.

The Company's Audit Committee is composed of four "independent" directors as defined by the Company's Corporate Governance Guidelines, the New York Stock Exchange rules, the Securities Exchange Act of 1934, SEC regulations thereunder, and the Company's Audit Committee Charter. The members of the Compensation and Nominating and Corporate Governance Committees are also

entirely composed of independent directors. The independent directorsBoard of Directors has also concluded that Thomas Lawley is an "independent director" under the Company are Henry B. Tippie, Wilton Looney, Bill J. DismukeCompany's Corporate Governance Guidelines and James B. Williams.the New York Stock Exchange listing standards.

Independence Guidelines. Under New York Stock Exchange listing standards, to be considered independent, a director must be determined to have no material relationship with the Company other than as a director. The New York Stock Exchange standards set forth a nonexclusive list of relationships which are conclusively deemed material.

The Company's Independence Guidelines (Appendix A to the Company's Corporate Governance Guidelines) are posted on the Company's website atwww.rollins.com under the Governance section. These Independence Guidelines provide that to be independent, a director must not have any relationship that would be considered material under New York Stock Exchange Standards. In addition, the Company's Guidelines provide that, except in special circumstances as determined by a majority of the Board, the following relationships are not material:

in any way on continued services) during every 12 month period within the past three (3) years;

years.

Audit Committee Charter. Under the Company's Audit Committee Charter, in accordance with New York Stock Exchange listing requirements and the Securities Exchange Act, of 1934, all members of the Audit Committee must be independent of management and the Company. A member of the Audit Committee is considered independent as long as he or she (i) does not accept any consulting, advisory, or compensatory fee from the Company, other than as a director or committee member; (ii) is not an affiliated person of the Company or its subsidiaries; and (iii) otherwise meets the independence requirements of the New York Stock Exchange and the Company's Corporate Governance Guidelines.

Nonmaterial Relationships. After reviewing all of the relationships between the members of the Audit Committee and Dr. Lawley, on the one hand, and the Company, on the other hand, the Board of Directors determined that noneneither any of the members of the Audit Committee nor Dr. Lawley had any relationships not included within the categorical standards set forth in the Independence Guidelines and disclosed above except as follows:

past, including charitable contributions made by the Foundation to the Emory University School of Medicine and to the Emory University School of Public Health. Gary Rollins is a director of Emory University.

As required by the Independence Guidelines, the Board of Directors unanimously concluded that the above-listed relationships would not affect the independent judgment of the independent directors, based on their experience, character and independent means, and therefore do not preclude an independence determination. All of the members of the Audit Committee are also independent under the heightened standards required for Audit Committee members.

In accordance with the NYSE corporate governance listing standards, Mr. Henry B. Tippie was elected as the Presiding Director. The Company's non-employeenon-management directors meet at regularly scheduled executive sessions without management. Mr. Tippie presides during these executive sessions.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines to promote better understanding of our policies and procedures. At least annually, the Board reviews these guidelines. A copy of our current Corporate Governance Guidelines may be found at our website (www.rollins.com) under the heading "Governance." As required by the rules of the New York Stock Exchange, our Corporate Governance Guidelines require that our non-management directors meet in at least two regularly scheduled executive sessions per year without management.

At our website (www.rollins.com), under the heading "Governance," you may access a copy of our Corporate Governance Guidelines, our Audit Committee Charter, our Code of Business Conduct and our Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transaction Policy. We will also provide a copy of any of these documents, free of charge, to any record or beneficial stockholder. Please make your request in writing, addressed to Harry J. Cynkus, Chief Financial Officer and Treasurer, Rollins, Inc. 2170 Piedmont Road, NE Atlanta, Georgia 30324.

Code of Business Ethics

The Company has adopted a Code of Business EthicsConduct applicable to all directors, officers and employees generally, as well as a Supplementalsupplemental Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transaction Policy applicable to directors and the principal executive officer, principal financial officers, and directors.officer, principal accounting officer or controller or person performing several functions for the Company. Both codes are available on the Company's website at www.rollins.com.www.rollins.com. Copies are also available in print, without charge, to any shareholder who requests one.

Director Communications

The Company also has a process for interested parties, including stockholders, to send communications to the Board of Directors, Presiding Director, any of the Board Committees or the non-management directors as a group. Such communications should be addressed as follows:

Mr. Henry B. Tippie

c/o Internal Audit Department

Rollins, Inc.

2170 Piedmont Road, N.E.

Atlanta, Georgia 30324.

Instructions for communications with the directors are also posted on our website atwww.rollins.com under the Governance section. All communications received from interested parties are forwarded to the Board of Directors. Any communication addressed solely to the Presiding Director or the non-management directors will be forwarded directly to the appropriate addressee. These instructions are posted on our website (www.rollins.com) under the heading "Governance."

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

None of the directors named above who serve on the Company's Compensation Committee are currently employees of the Company. Mr. Tippie was employed by the Company from 1953 to 1970, and held several offices with the Company during that time, including as Executive Vice President—Finance, Secretary, Treasurer and Chief Financial Officer.

REPORTS OF THE AUDIT ANDDIRECTOR COMPENSATION COMMITTEESAND PERFORMANCE GRAPH

The following table sets forth compensation to our directors for services rendered as a director. Two of our directors, R. Randall Rollins and Gary W. Rollins, are our employees. Mr. R. Randall Rollins' and Gary W. Rollins' compensation are set forth in the Summary Compensation Table below under Executive Compensation. Other than Mr. Tippie, the directors listed below have never been employed by the Company or paid a salary or bonus by the Company, have never been granted any options or other stock based awards, and do not participate in any Company sponsored retirement plans. Mr. Tippie has not been employed by the Company or paid a salary or bonus by the Company, has not been granted any options or other stock based awards, and has not participate in any Company sponsored retirement plans since his employment with the Company ceased in 1970.

| Name | Year | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Total ($) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Henry B. Tippie | 2007 | 78,500 | — | — | 78,500 | |||||

| Wilton Looney | 2007 | 41,500 | — | — | 41,500 | |||||

| James B. Williams | 2007 | 41,500 | — | — | 41,500 | |||||

| Bill J. Dismuke | 2007 | 36,500 | — | — | 36,500 | |||||

| Thomas J. Lawley | 2007 | 26,250 | — | — | 26,250 |

Directors that are our employees do not receive any additional compensation for services rendered as a director. During fiscal 2007, the Company's standard compensation arrangements for non-employee directors were as follows:

| Annual Retainer | 20,000 | |

| Audit Committee Chair Additional Annual Retainer | 14,000 | |

| Compensation Committee Chair Additional Annual Retainer | 8,000 | |

| Nominating and Corporate Governance Committee Chair Additional Annual Retainer | 5,000 | |

| Diversity Committee Chair Additional Annual Retainer | 5,000 | |

| In Person Board Meetings | 1,250 | |

| In Person Committee Meeting | 1,250 | |

| Telephonic Audit Committee Meeting | 1,250 | |

| In Person Audit Committee Meeting | 2,250 | |

| Pre-Board Meeting | 1,250 |

Under the current compensation arrangements effective January 1, 2008, non-management directors each receive an annual retainer fee of $24,000. In addition, the Chairman of the Audit Committee receives an annual retainer of $16,000, the Chairman of the Compensation Committee receives an annual retainer of $9,000 and the chairman of each of the Corporate Governance/Nominating Committee and Diversity Committee receives an annual retainer of $6,000. A director that chairs more than one committee receives a retainer with respect to each Committee he chairs. All of

the retainers are paid on a quarterly basis. Current per meeting fees for non-management directors are as follows:

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate other Companyfuture filings, including this Proxy Statement, in whole or in part, the following Report of the Audit Committee Report of the Compensation Committee on Executive Compensation and the Performance Graph included herein shall not be incorporated by reference into any such filings.

Management is responsible for the Company's internal controls and the financial reporting process. The Company's independent public accountants areaccounting firm is responsible for performing an independent audit of the Company's consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for issuing a report thereon. The Audit Committee's responsibility is generally to monitor and oversee these processes, as described in the Audit Committee Charter. It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles; that is the responsibility of management.

In fulfilling its oversight responsibilities with respect to the year ended December 31, 2005,2007, the Audit Committee:

Based upon the review and discussions referred to above, the Committee recommended to the Board of Directors that the audited consolidated financial statements of the Company and subsidiaries as of December 31, 20052007 and 20042006 and for the three years ended December 31, 2005, 2004 and 20032007 be included in the

included in the Company's Annual Report on Form 10-K for the year ended December 31, 20052007 for filing with the Securities and Exchange Commission.

In giving its recommendation to the Board of Directors, the Audit Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and (ii) the report of Grant Thorntonthe Company's independent registered public accounting firm with respect to such financial statements.

Submitted by the Audit Committee of the Board of Directors.

AUDIT COMMITTEE

Henry B. Tippie, Chairman

Wilton Looney

James B. Williams

Bill Dismuke

REPORT OF THE COMPENSATION COMMITTEEON EXECUTIVE COMPENSATIONDISCUSSION AND ANALYSIS

TheCompensation Committee

During the fiscal year ended December 31, 2007, the members of our Compensation Committee of the Board of Directors hasheld primary responsibility for determining the base salary for all of the executive officers, the stock-based incentive plans for all of the executive officers, as well as the cash incentive plan for all of the executive officers.compensation levels. The Compensation Committee is comprisedcomposed of outsidethree of our non-management directors who aredo not eligible to participate in the Company's compensation plansplans. The Committee determines the compensation and over whose names this report is presented.administers the performance-based cash compensation plan for our executive officers. In addition, the Committee also administers our Stock Incentive Plan for all the employees.

The members of our Compensation Committee have extensive and varied experience with various public and private corporations—as investors and stockholders, as senior executives, and as directors charged with the oversight of management and the setting of executive compensation levels. Henry B. Tippie, the Chairman of the Compensation Committee, has served on the board of directors of twelve different publicly traded companies and has been involved in setting executive compensation levels at all of these companies. Messrs. Wilton Looney and James B. Williams have served on the board of directors of several different publicly traded companies and have similarly been involved in setting executive compensation levels at many of these companies.

The Compensation Committee has authority to engage attorneys, accountants and consultants, including executive compensation consultants, to solicit input from management concerning compensation matters, and to delegate any of its responsibilities to one or more directors or members of management where it deems such delegation appropriate and permitted under applicable law. The Committee has not used the services of any compensation consultants in determining or recommending the amount of form of executive compensation.

The Compensation Committee believes that determinations relative to executive compensation levels are best left to the discretion of the Committee. In addition to the extensive experience and expertise of the Committee's members and their familiarity with the Company's performance and the performance of our executive officers, the Committee is able to draw on the experience of other directors and on various legal and accounting executives employed by the Company, isand the Committee has access to the wealth of readily available public information relative to structuring executive compensation programs and setting appropriate compensation levels. The Committee also believes that the structure of our executive compensation programs should not become overly complicated or difficult to understand. The Committee solicits input from our Chief Executive Officer with respect to the performance of our executive officers and their compensation levels.

General Compensation Objectives and Guidelines

We are engaged in a highly competitive industry. The actions of the executive officers have a profound impactWe believe that our success depends on the short-termour ability to attract and long-term profitability of the Company; therefore, the design of the executive officer compensation package is very important.retain highly qualified and motivated executives. In order to retain key employees, the Company has anaccomplish this objective, we have endeavored to structure our executive compensation packagein a fashion that is based on increase in shareholder value, the overalltakes into account our operating performance of the Company, and the individual performance of the executive.

The measuresCompensation Committee endorses the philosophy that executive compensation should reflect Company performance and the contribution of executive officers to that performance. The Company's compensation policy is designed to achieve three fundamental objectives: (i) attract and retain qualified executives, (ii) motivate performance to achieve Company objectives, and (iii) align the interests of our executives with the long-term interests of the Company's stockholders.

The Committee recognizes that there are many intangibles involved in evaluating performance consideredand in motivating performance, and that determining an appropriate compensation level is a highly subjective endeavor. The analysis of the Committee is not based upon a structured formula and the objectives referred to above are not weighted in any formal manner.

Pursuant to our compensation philosophy, the total annual compensation of our executive officers is primarily made up of one or more of three elements. The three elements are salary, annual performance-based incentive compensation and grants of stock based awards such as restricted stock.

We believe a competitive base salary is important to attract, retain and motivate top executives. We believe annual performance-based incentive compensation is valuable in recognizing and rewarding individual achievement. Finally, we believe equity-based compensation makes executives "think like owners" and, therefore, aligns their interests with those of our stockholders.

Effective November 1, 2006, we adopted formal Stock Ownership Guidelines for our executive officers and note that our executive officers are significant stockholders of the Company, as disclosed elsewhere in this Proxy Statement. The purpose of these Guidelines is to align the interests of executives with the interests of shareholders and further promote our longstanding commitment to sound corporate governance.

The Committee is mindful of the stock ownership of our directors and executive officers but does not believe that it is appropriate to provide a mechanism or formula to take stock ownership (or gains from prior option or stock awards) into account when setting compensation levels. As do many public companies, we have historically provided in our insider trading policies that directors and executive officers may not sell Company securities short and may not sell puts, calls or other derivative securities tied to our Common Stock.

We expect that the salary and other compensation paid to our executive officers will qualify for income tax deductibility under the limits of Section 162(m) of the Internal Revenue Code However, it is possible that the Committee may authorize compensation which may not, in a specific case, be fully deductible by the Company.

The Company does not have a formal policy relative to the adjustment or recovery of incentives or awards in the event that the performance measures upon which incentives or awards were based are later restated or otherwise adjusted in a manner that would have reduced the size of an incentive or award. However, as all incentives and awards remain within the discretion of the Compensation Committee, the Committee retains the ability to take any such restatements or adjustments into account in subsequent years.

Salary

The salary of each executive officer is determined by the Compensation Committee. In making its determinations, the Committee in determining 2005 executive officer compensation were primarily revenue growth, pretax profit plan achievement,gives consideration to our operating performance for the prior fiscal

year and pretax profit improvement over the past year.

Pursuantindividual executive's performance. The Committee solicits input from our Chief Executive Officer with respect to the above compensation philosophy, the three main components of the executive compensation package are base salary, an incentive cash plan and stock-based incentive plans.

The factors subjectively used in determining base salary include the recent profit performance of our executive officers and their compensation levels. Effective January 1, 2008, the Company,following adjustments were made to the magnitude of responsibilities, the scope of the position, individual performance and the pay received by peers in similar positions in the same geographic area. These factors are not used in any specific formula or weighting. Thebase salaries of theour executive officers are reviewed annually. Three executive officers received raises in 2005 that were based on company performance as well as their individual performancesofficers: Gary W. Rollins $1,000,000 (no change from 2007); R. Randall Rollins: $900,000 (no change from 2007); Glen Rollins $680,000 ($80,000 increase from 2007); Harry J. Cynkus $450,000 ($50,000 increase from 2007); and overall departmental improvements.Michael W. Knottek $415,000 ($30,000 increase from 2007).

Performance-Based Plan

At the Annual Meetingannual meeting of stockholders held on April 22, 2003, the stockholders approved the terms of the Company's Performance-Based Incentive Cash Compensation Plan for Executive Officers (the "Cash"2003 Cash Incentive Plan"). Under the 2003 Cash Incentive Plan, executive officers have an opportunity to earn bonuses of up to 80% of their base salaries, not to exceed a maximum dollar amount of $2,000,000 per individual per year, upon achievement of bonus performance goals, which are preset every year by the Compensation Committee upon its approval of the performance bonus program for that year. The 2003 Cash Incentive Plan expires on April 22, 2008. The Board has submitted for approval of the stockholders at the Annual Meeting a new Performance-Based Incentive Cash Compensation Plan for Executive Officers (the "2008 Cash Incentive Plan") which is more fully described below under "Approval of Performance-Based Incentive Cash Compensation Plan for Executive Officers."

For 20052007, these performance goals were measured by attainment of specific levels of the following: Rollins, Inc. revenue growth, pretax profit plan achievement, and pretax profit improvement over the prior year. The Compensation Committee set a maximum award for fiscal year 2007 of 80% of the executive's base salaries for Messrs. R. Randall Rollins, Gary W. Rollins and Glen Rollins and 60% of the executive's base salary for fiscal year 2007 for Messrs. Harry J. Cynkus and Michael W. Knottek. Subject to stockholders approval of the 2008 Cash Incentive Plan, the Compensation Committee approved bonus awards and performance goals for 2005 were pre-established2008 under that plan. For 2008 these performance goals will be measured by attainment of specific levels of the following: revenue growth, pretax profit plan achievement, and pretax profit improvement over the prior year. The Compensation Committee has set maximum awards for fiscal year 2008 of 100% of base salaries for Messrs. R. Randall Rollins and ratified byGary W. Rollins, and 80% of base salary for Mr. Glen Rollins. Messrs. Harry J. Cynkus and Michael W. Knottek have a maximum award potential of 60% of their base salaries for fiscal year 2008. Under the Board2003 and 2008 Cash Incentive Plans the Company must achieve 95 percent and 90 percent, respectively, of Directorsplanned income for allthe executive officers.officers to be eligible for bonuses under those plans. These cash compensation performance goals of the 2003 and 2008 Cash Incentive Plans are difficult to achieve, but achievable. The Committee believes that the 2003 and 2008 Cash Incentive PlanPlans and the performance bonus programs thereunder provide performance incentives that are and will be beneficial to Rollins, Inc.the Company and its stockholders. This

Messrs. Harry J. Cynkus and Michael W. Knottek also participate in the Company's Home Office Bonus Plan. Under this Plan, the participants may receive a bonus of up to five percent in 2007 (and ten percent in 2008) of the participant's annual salary for achievement of the participant's expense plan will be in place until April 22, 2008. Alland an additional five percent (for both 2007 and 2008) of theannual salary for achievement of internal customer service survey results.

Executive Officers participating in Cash payments under the Cash Incentive Plan and the Home Office Plan are paid the following year. Payments made under the 2003 Cash Incentive Plan and the Home Office Plan in 2008 to the executive officers are as follows: Gary W. Rollins $394,063; Harry J. Cynkus $144,213; R. Randall Rollins $354,657; Glen Rollins $236,438 and Michael W. Knottek $128,795.

In addition to any bonuses earned under the Cash Incentive Plan or Home Office Plan, the Compensation Committee has the authority to award discretionary bonuses if the Committee finds that circumstances warrant that act.

Equity Based Awards

Our Stock Incentive Plan allows for a bonuswide variety of stock based awards such as stock options and restricted stock awards. We last issued stock options in fiscal year ended 2003 and have no immediate plans to issue additional stock options. Partially in response to changes relative to the manner in which stock options are accounted for 2005 as a resultunder generally accepted accounting principles, we have modified the structure and composition of achievementthe long-term equity based component of pre-established performance goals.our executive compensation. In recent years, we have awarded time-lapse restricted stock in lieu of granting stock options. The terms and conditions of these awards are described in more detail below.

Awards under the Company's stock incentive plansStock Incentive Plan are purely discretionary, and are not based upon any specific formula and may or may not be granted in any given fiscal year. For the past three years, we have granted time-lapse restricted stock to various employees, including our executive officers, in early January during our regularly scheduled meeting of the Compensation Committee during which the Committee reviews executive compensation. Consistent with this practice, we granted restricted stock awards to our executive officers in January 2006, 2007 and 2008 as follows:

| Name | 2006 | 2007 | 2008 | |||

|---|---|---|---|---|---|---|

| Gary W. Rollins | 37,500 | 37,500 | — | |||

| R. Randall Rollins | 22,500 | 30,000 | — | |||

| Glen Rollins | 18,000 | 22,500 | 30,000 | |||

| Harry J. Cynkus | 15,000 | 15,000 | 20,000 | |||

| Michael W. Knottek | 15,000 | 15,000 | 20,000 |

It is our expectation to continue yearly grants of restricted stock awards to selected executives although we reserve the right to modify or discontinue this or any of our other compensation practices at anytime.

To date, all of our restricted stock awards have had the same features. The shares vest one-fifth per year beginning on the second anniversary of the grant date. Restricted shares have full voting and dividend rights. However, until the shares vest, they cannot be sold, transferred or pledged. Should the executive leave our employment for any reason prior to the vesting dates (other than due to death or retirement on or after age 65), the unvested shares will be forfeited. In the event of a "change in control" of the Company, the Compensation Committee has the discretion to accelerate vesting of the shares.

Grants are made under our Stock Incentive Plan and the plan is administered pursuant to Rule 16b-3 of the Securities Exchange Act of 1934. When considering the grant of stock options and other equity compensation (such as restricted stock),based awards, the Compensation Committee gives consideration to theour overall performance of the Company and the performance of individual employees. Grants

Employment Agreements

There are no agreements or understandings between the Company and any executive officer which guarantee continued employment or guarantee any level of compensation, including incentive or bonus payments, to the executive officer.

Retirement Plans

The Company maintains a defined benefit plan (Rollins, Inc. Retirement Income Plan) for employees hired prior to January 1, 2002, a non-qualified retirement plan (Rollins, Inc. Deferred Compensation Plan) for our executives, and a 401(k) savings plan (Rollins 401(k) Plan) for the benefit of all of our eligible employees.

The Company froze the Rollins, Inc. Retirement Income Plan effective June 30, 2005. Due to the freeze of the Rollins, Inc. Retirement Income Plan, for certain of our older and more tenured employees who are participants in the Rollins, Inc. Retirement Income Plan, the Company makes additional company contributions ("Pension Restoration Contributions") into either the 401(k) Plan (for non-highly compensated employees) or into the Rollins, Inc. Deferred Compensated Plan (for highly compensated employees). This contribution will be made for five years. The first contribution was made in January 2007 for those participants who were employed for all of the 2006 plan year. Only employees with five full years of vested service on June 2005 qualify for the Pension Restoration Contributions. Messrs. Randall Rollins, Gary Rollins, Glen Rollins, Michael Knottek and Harry Cynkus are expected to receive Pension Restoration Contributions of 3%, 3%, 1.5%, 3%, and 3% of their annual salary (up to a maximum 2007 annual salary of $225,000), respectively, annually under the Rollins, Inc. Deferred Compensation Plan. The Rollins, Inc. Deferred Compensation Plan also provides other benefits as described below under "Nonqualified Deferred Compensation").

Other Compensation

Other compensation to our executive officers includes group welfare benefits including group medical, dental and vision coverage, and group life insurance. The Company provides certain perquisites to its executive officers which are described below under "Executive Compensation." The Company requires that its Chairman and its President and CEO use Company or other private aircraft for air travel whenever practicable for security reasons.

The following Compensation Committee Report shall not be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the "Securities Act"), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the Securities Act or the Exchange Act.

We have reviewed and discussed the above Compensation Discussion and Analysis with management.

Based upon this review and discussion, we have recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company's stock incentive plansAnnual Report on Form 10-K for the year ended December 31, 2007 and the plans are administered by non-employee directors within the meaningthis proxy statement.

Compensation Committee

Henry B. Tippie, Chairman

Wilton Looney

James B. Williams

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of Rule 16b-3 under the Securities Exchange Act of 1934 requires our officers and directors and persons who own more than ten percent of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than ten percent stockholders are required to furnish the Company with copies of all Section 16(a) forms they file.

Based on our review of the copies of such forms, we believe that during fiscal year ended December 31, 2007, all filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were timely satisfied, except each of Messrs. Cynkus and Knottek filed one Form 4 after its due date reporting the delivery of common stock in payment of a tax liability associated with the vesting of a previously reported restricted stock award exempt from Section 16(b) of the Securities and Exchange Act of 1934 by reason of Rule 16(b)(3).

Shown below is information concerning the annual compensation for the fiscal year ended December 31, 2007 and 2006 of those persons who were at December 31, 2007:

| Name and Principal Position | Year | Salary ($)(1) | Stock awards ($)(2) | Option awards ($)(3) | Non-equity incentive plan compensation ($)(4) | Change in pension value and non-qualified deferred compensation earnings ($)(5) | All other compensation ($)(6) | Total ($) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gary W. Rollins Chief Executive Officer | 2007 2006 | 1,000,000 1,000,000 | 284,708 196,542 | 166,563 166,563 | 394,063 442,156 | — 386,996 | 347,384 360,122 | 2,192,718 2,552,379 | ||||||||

| Harry J. Cynkus Chief Financial Officer | 2007 2006 | 400,000 350,000 | 119,870 68,163 | 17,370 17,370 | 144,213 123,676 | — 21,456 | 22,550 14,197 | 704,004 594,862 | ||||||||

| R. Randall Rollins Chairman of the Board | 2007 2006 | 900,000 850,000 | 166,792 96,582 | 79,713 79,713 | 354,657 375,172 | — — | 38,278 37,148 | 1,539,440 1,438,615 | ||||||||

| Glen Rollins Vice President | 2007 2006 | 600,000 500,000 | 138,573 85,673 | 62,933 62,933 | 236,438 220,570 | — 24,103 | 22,748 17,285 | 1,060,692 910,564 | ||||||||

| Michael W. Knottek Senior Vice President | 2007 2006 | 385,000 350,000 | 119,870 68,163 | 17,370 17,370 | 128,795 123,676 | — 33,860 | 21,198 15,224 | 672,233 608,293 | ||||||||

| Mr. Gary W. Rollins: | $6,750 of Company contributions to the employee's account of the Rollins 401(k) plan; $294,845 of incremental costs to the Company for personal use of the Company's airplane (calculated based on the actual variable costs to the Company for such usage); $13,793 of tax reimbursement payments to offset taxes payable for airplane usage; $6,600 of Company contributions to the employee's account of the Rollins deferred compensation plan; car allowance and related vehicle expenses; incremental costs to the Company for use of the Company's executive dining room; and use of Company storage space. | |

Mr. Harry J. Cynkus: | $6,750 of Company contributions to the employee's account of the Rollins 401(k) plan; $6,600 of Company contributions to the employee's account of the Rollins deferred compensation plan; car lease payments and related vehicle expenses; and incremental cost to the Company for use of the Company's executive dining room. | |

Mr. R. Randall Rollins: | $6,750 of Company contributions to the employee's account of the Rollins 401(k) plan; $6,600 of Company contributions to the employee's account of the Rollins deferred compensation plan; Company provided automobile and related vehicle expenses; and incremental cost to the Company for use of the Company's executive dining room. | |

Mr. Glen Rollins: | $6,750 of Company contributions to the employee's account of the Rollins 401(k) plan; $3,300 of Company contributions to the employee's account of the Rollins deferred compensation plan; car allowance and related vehicle expenses; and incremental cost to the Company for use of the Company's executive dining room. | |

Mr. Michael W. Knottek: | $6,750 of Company contributions to the employee's account of the Rollins 401(k) plan; $6,600 of Company contributions to the employee's account of the Rollins deferred compensation plan; car lease payments and related vehicle expenses; and incremental cost to the Company for use of the Company's executive dining room. |

The shares of Common Stock disclosed in the table below represent grants of restricted sharesCommon Stock under our Stock Incentive Plan awarded in fiscal year 2007. All grants of restricted Common Stock vest over six years, 20%one-fifth per year beginning aton the endsecond anniversary of the second year. In general, these grants were based upongrant date. Restricted shares have full voting and dividend rights. However, until the scopeshares vest, they cannot be sold, transferred or pledged. Should the executive leave our employment for any reason prior to the vesting dates (other than due to death or retirement on or after age 65), the unvested shares will be forfeited. We have not issued any stock options in the past three fiscal years and have no immediate plans to issue additional stock options.

| | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards | | | |||||||||

| | | | Grant Date Fair Value of Stock and Option Awards(3) | ||||||||||

| | | | |||||||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | All Other Stock Awards: Number of Shares of Stock or Units (#) | ||||||||

| Gary W. Rollins | 1/23/07 1/23/07 | (1) | 243,056 | 425,456 | 800,000 | 37,500 | $ | 529,000 | |||||

| Harry J. Cynkus | 1/23/07 1/23/07 | (2) | 68,611 | 140,091 | 240,000 | 15,000 | $ | 211,600 | |||||

| R. Randall Rollins | 1/23/07 1/23/07 | (1) | 218,750 | 382,910 | 720,00 | 30,000 | $ | 423,200 | |||||

| Glen Rollins | 1/23/07 1/23/07 | (1) | 145,834 | 255,274 | 480,000 | 22,500 | $ | 317,400 | |||||

| Michael W. Knottek | 1/23/07 1/23/07 | (2) | 66,038 | 134,838 | 231,000 | 15,000 | $ | 211,600 | |||||

The Compensation Committee's general policy is to seek exclusion of any compensation resulting from the exercise of optionsawards granted under the Company's 1998 Employee Stock Incentive Plan from the calculation of whether an employee's compensation exceeds the $1 million deductibility limit imposed by Section 162(m) of the Internal Revenue Code of 1986, as amended. However, the Committee has evaluated the future status of the participants in the Company's stock plans and has determined that certain participants will exceed the $1 million aggregate compensation limit during future fiscal years, and the Committee reserves the right to deviate from its general policy if warranted. The Committee also seeks to exclude awards made under the2003 Cash Incentive Plan from the calculationin January 2007. The actual awards were approved in February 2008. The amounts of the Section 162(m) deductibility limit. Theactual payments are included in the Summary Compensation Committee believes that compensation for 2005Table.

CEO COMPENSATION

The CEO's compensation is determined by the Compensation Committee. Forrestricted Common Stock awarded in fiscal year 2005,2007 under our Stock Incentive Plan computed in accordance with FAS 123R. Please refer to Note 9 to our Financial Statements contained in our Form 10-K for the cashperiod ending December 31, 2007 for a discussion of assumptions used in this computation. Our Form 10-K has been included in our Annual Report and provided to our stockholders.

There are no agreements or understandings between the Company and any executive officer which guarantee continued employment or guarantee any level of compensation, for Gary W. Rollins was $1,341,538,including incentive or bonus payments, to the executive officer. All of which $1,000,000 was base salary and $341,538 was a cash incentive bonus paidthe named executive officers participate in the first quarter of 2006 for 2005 performance. In addition, during the first quarter 2006, Mr. Rollins was granted 25,000 shares of restricted stock that vest in 20 percent annual increments beginning in 2008, based on the factors discussed below with respect to base salary. Mr. Rollins received a bonus due to the achievement of pre-set bonus performance goals, as described below.Company's Cash Incentive Plan. Bonus awards under the Rollins, Inc. Executive BonusCash Incentive Plan provide participants an opportunity to earn an annual bonus in a maximum amount of 80% of base salary or $2 million per individual per year, whichever is less. Under the Executive BonusCash Incentive Plan, whether a bonus is payable, and the amount of any bonus payable, is contingent upon achievement of certain performance goals which are set in the annual Programprogram adopted under the Executive Bonus Plan. Performance goals are measured according to one or more of the following three targeted financial measures: revenue growth, achievement of pretax profit targets, and pretax profit improvement over the prior year. The 2005 bonus was awarded based upon all three of these measures.

The CEO's base salary was determined based upon the increase in shareholder value which occurred in 2004 and 2005, the overall performance of the Company, and the CEO's individual performance. The decision of the Compensation Committee was, however, subjective and was not based upon any specific formula or guidelines. The Compensation Committee does not consult with the CEO when the CEO's salary is determined. In 2005, no member of the Compensation Committee participated in any Company incentive program.

COMPENSATION COMMITTEEHenry B. Tippie, ChairmanWilton LooneyJames B. Williams

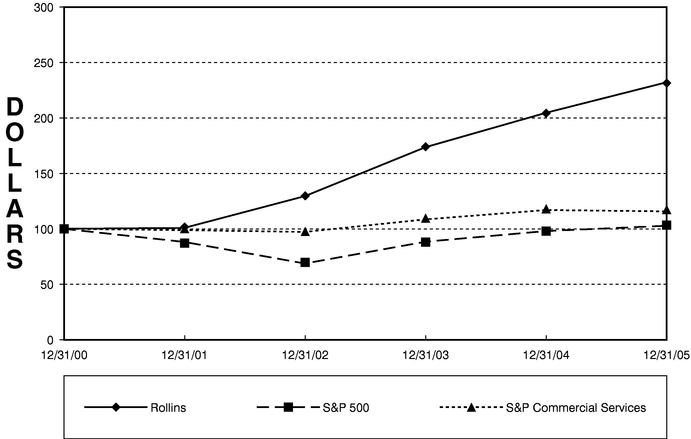

In conjunction with the executive compensation information presented in this Proxy Statement, the SEC requires a five year comparison of the cumulative total stockholder return based on the performance of the stock of the Company as compared with both a broad equity market index and an industry or peer group index. The indices included in the following graph are the S&P 500 Index and the S&P 500 Commercial Services Index.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN*

ASSUMES INITIAL INVESTMENT OF $100*TOTAL RETURN ASSUMES REINVESTMENT OF DIVIDENDSNOTE: TOTAL RETURNS BASED ON MARKET CAPITALIZATION

EXECUTIVE EMPLOYMENT CONTRACTS

The Company's employment contracts with its Chief Executive Officer and the Company's other four most highly compensated executive officers (the "Named Executive Officers") are oral, at will arrangements. Set forth below is a summary of the material terms of the compensation under such at will arrangements.

The Named Executive Officers do not have guaranteed terms of employment. None of the Named Executive Officers are entitled to severance payments, or any termination or other payments relating to a change of control, in excess of $100,000.

Base Salaries

The 2006 annual base salaries for the Company's Named Executive Officers as of March 17, 2006 were as follows:

| R. Randall Rollins, Chairman of the Board | $ | 850,000 | |

| Gary W. Rollins, President, Chief Executive Officer and Chief Operating Officer | $ | 1,000,000 | |

| Glen Rollins, Vice President | $ | 500,000 | |

| Harry J. Cynkus, Chief Financial Officer and Treasurer | $ | 350,000 | |

| Michael W. Knottek, Senior Vice President and Secretary | $ | 350,000 |

Executive Bonus Plan

All of the Named Executive Officers participate in the Company's Executive Bonus Plan program. The Executive Bonus Plan program consists of two parts, the Performance-Based Cash Incentive Bonus Plan (the "Performance Bonus Plan") and the Home Office Bonus Plan (the "Home Office Plan"), both of which are described further below. Bonus opportunities are granted annually as follows:

Performance-Based Cash Incentive Bonus Plan (the "Performance Bonus Plan"). Bonus awards under the Performance Bonus Plan provide participants an opportunity to earn an annual bonus in a maximum amount of 80% of base salary or $2 million per individual per year, whichever is less. Under the Performance Bonus Plan, whether a bonus is payable, and the amount of any bonus payable, is contingent upon achievement of certain performance goals which are set in the annual Program adopted under the Performance Bonus Plan.plan. Performance goals are measured according to one or more of the following three targeted financial measures: revenue growth, achievement of preset pretax profit targets, and pretax profit improvement over the prior year. For 2007 these performance goals were

measured by attainment of specific levels of the following: revenue growth, pretax profit plan achievement, and pretax profit improvement over the prior year. The Compensation Committee has set a maximum award of 80% of executive's base salaries as the award for fiscal year 2007 for Messrs. R. Randall Rollins, Gary W. Rollins and Glen Rollins. The Compensation Committee has set a maximum award of 60% of executive's base salaries as the award for fiscal year 2007 for Messrs. Cynkus and Knottek. In addition, Messrs. Harry J. Cynkus and Michael W. Knottek participate in the Home Office Plan. Under this Plan, the participants may receive a bonus of up to 10% of the participant's annual salary for achievement of the participant's expense plan and an additional 5% of annual salary for achievement of internal customer service survey results. Unless sooner amended or terminated by the Compensation Committee, the Performance Bonus Plan will be in place until April 22, 2008.

Home Office Bonus Plan (the "Home Office Plan"). Messrs. Knottek and Cynkus also participate in the Company's Home Office Plan. Under the Home Office Plan, participants receive an opportunity

to earn bonuses based on achievements in their department's customer service and their cumulative department performance to the current year's Home Office department budgets.

Stock Options and Other Equity Awards

The Named Executive Officersnamed executive officers are eligible to receive options and restricted stock under the Company's stock incentive plan, in such amounts and with such terms and conditions as determined by the Compensation Committee at the time of grant. The Company's standard formsAll of option and restricted stock grant agreementsthe executive officers are filed as material contracts witheligible to participate in the Company's periodic reports.

Automobile Usage

Michael Knottek and Harry Cynkus are each entitled to the use of company-leased automobiles. Both automobiles are insured by the Company, and they are leased for $980.35 and $909.96 per month, respectively. Messrs. Knottek and Cynkus each pay the Company $325 per month for their personal use of the automobiles.

Airplane Usage

At the January 24, 2006 meeting of theDeferred Compensation Committee, the Compensation Committee approved new rules for use ofPlan. The executive officers participate in the Company's aircraft.regular employee benefit programs, including the 401(k) Plan with Company match, group life insurance, group medical and dental coverage and other group benefit plans. The Deferred Compensation Plan provides that participants may defer up to 50% of their base salary and up to 100% of their annual bonus with respect to any given plan year, subject to a $2,000 per plan year minimum. The Company requires the Chairman and President & CEOmay make discretionary credits to use Company aircraft for all travel whenever practicable for security reasons. The value of personal aircraft usage will be imputed to them as income from the Company, effective January 1, 2005. This value will be calculated using an aggregate incremental cost method, based on the variable operating costs to the Company, including a gross-up for taxes due.participant accounts.

EXECUTIVE COMPENSATIONOUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END